Money stress is real. Between paying bills, handling responsibilities, and trying to have a life, it can feel like there’s never enough to go around.

But you don’t have to give up the things you love just to feel financially secure. You can have both.

Think it’s too late because you’re past 30? It’s not. It doesn’t matter when you start—what matters is that you do.

Every stage of life gives you the chance to take control of your finances and set yourself up for the future.

You don’t need to overhaul your whole life overnight. Small, consistent steps can make all the difference.

Maybe you’re paying off student loans, raising a family, or trying to save for something bigger. No matter what’s on your plate, little changes today can give you more confidence and freedom down the road.

It’s never too late to start building the financial future you want.

Here are some simple, stress-free ways to get on track, without feeling like you have to sacrifice everything else.

Start Strong in Your 20s

Your 20s are the foundation years for your financial future. They’re a time of growth, experimentation, and—often making mistakes.

But when it comes to money, starting strong can make all the difference. Let’s go right into the essentials.

Establishing a Realistic Budget

If the word “budget” makes you cringe, you’re not the only one. Many people think of it as restrictive, but in reality, a good budget is all about giving you control over where your money goes.

First things first: you need to track your income and expenses. You can’t manage what you don’t measure, right?

- Start Tracking: Jotting down expenses isn’t glamorous, but it’s essential. Apps like Mint or YNAB (You Need a Budget) can do the heavy lifting for you, making it easy to see where every dollar goes.

- Set Realistic Goals: Is your goal to pay off student loans faster, save for a dream vacation, or just stop living paycheck to paycheck? Once you know what you’re aiming for, it’s easier to decide how much to spend, save, and even splurge.

- Use the 50/30/20 Rule: Allocate 50% of your income to needs (rent, bills, groceries), 30% toward wants (streaming subscriptions, dining out), and 20% to savings or paying off debt. Adjust the percentages if needed to fit your situation.

Pro tip: If budgeting feels overwhelming, start small. Something as simple as cutting back on unused subscriptions can free up cash you didn’t realize was slipping away.

Building an Emergency Fund Early

Life happens. Whether it’s an unexpected car repair, losing a job, or an emergency medical bill, having an emergency fund is like being your own superhero.

And no, you don’t need to save thousands overnight. Starting small can still give you peace of mind.

- Aim for 3-6 Months of Expenses: This might feel like a daunting number, but breaking it down can make it more manageable. Start with a goal of $500 or $1,000, then keep building.

- Make Saving Automatic: Set up automatic transfers to a high-yield savings account. The less you think about it, the easier it becomes.

- Celebrate Milestones: Reward yourself for every $100 or $500 saved. It’ll keep you motivated to hit the next milestone.

Building a financial buffer early creates breathing room later. Even small contributions snowball over time, especially if you’re consistent.

Getting Comfortable Investing

Investing in your 20s might sound intimidating, but it’s one of the smartest moves you can make. The earlier you start, the more time your money has to grow.

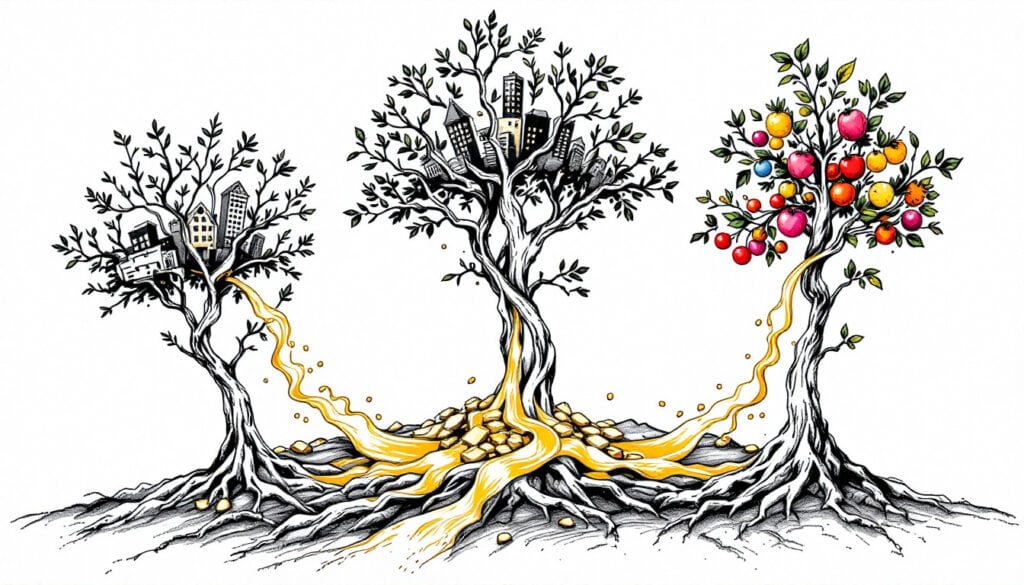

Think of investing as planting seeds—you won’t see results overnight, but the long-term rewards can be huge.

- Start With Retirement Accounts: If your job offers a 401(k) with a match, take it—it’s free money! If not, opening an IRA (Individual Retirement Account) is a solid alternative. Contribute what you can, even if it’s just $50 a month.

- Keep It Simple: You don’t have to become a stock market expert. Look into low-cost index funds or ETFs, which spread your investments across a variety of companies to lower your risk.

- Try Dollar-Cost Averaging: This means investing a fixed amount on a regular schedule, no matter what the market is doing. It’s a strategy that smooths out market highs and lows over time.

Imagine this: investing just $100 a month from age 25 can grow into a six-figure portfolio by the time you’re 65, thanks to compound growth. That’s money working while you sleep!

Taking these steps in your 20s might feel like baby steps in a marathon, but trust me, they add up in ways you won’t believe.

Starting small is still starting. You’ll thank yourself later for laying that groundwork now.

Navigating the Challenges of Your 30s

Your 30s are often a significant chapter, like starting a new season in your favorite show where life tosses in higher stakes with greater opportunities.

Does this sound familiar? You’re probably balancing more responsibilities while aiming to crush those big life goals.

Whether it’s paying down debt, planning for the future, or securing your financial stability, this time can feel like a juggling act.

Don’t worry, small adjustments and intentional steps will help you navigate it all with confidence.

Managing Debt Strategically

If your 20s were marked by accumulating debt (hello, student loans or credit cards), your 30s are the perfect time to master the art of reducing it. Tackling debt is all about strategy.

Two popular methods to attack high-interest debt are the debt snowball and debt avalanche:

- The Snowball Method: Focus on paying off smaller debts first, while sticking to minimum payments on larger ones. As you knock out those small balances, the sense of accomplishment motivates you to keep going.

- The Avalanche Method: Prioritize debts with the highest interest rate. While this method saves you more money in the long term, it takes a bit more patience since progress might feel slower at first.

Not sure where to start? Take inventory of all your debts, noting balances and interest rates. Then, choose the method that aligns best with your money personality.

Better yet, use apps like YNAB or Mint to track progress and stay organized.

Pro tip: While paying loans down, don’t forget to save for your future.

Setting even 5-10% of your income aside for investments or retirement savings keeps you from delaying wealth-building opportunities.

Planning for Long-Term Goals

Your 30s are prime time to start saving for the dreams that truly matter, like buying a home, starting a family, or launching your own business.

Sounds overwhelming? Think of goal-based saving like assembling IKEA furniture. Complicated at first, but manageable step by step.

Start by setting specific, time-bound goals. “I want to save $40,000 in five years for a down payment” is much clearer than “I need more savings.”

Once you know the timeline, divide that total into monthly savings. Using tools like online high-yield savings accounts is a great way to make your money work harder.

Here are a few examples of goals and how to approach them:

- Buying a Home: Save for a down payment while studying first-time buyer programs in your area.

- Starting a Family: Between medical expenses or planning for childcare, mapping out costs ahead can relieve financial stress.

- Entrepreneurship: If launching a small business is in your plan, explore grants or startup loans tailored for entrepreneurs.

Remember, achieving goals is rarely linear. Give yourself grace and adjust timelines when needed.

Re-evaluating Insurance Needs

Your 30s come wrapped in bigger responsibilities, and along with them comes the need to protect what you’ve worked so hard for. Insurance might not be the most glamorous topic, but it’s the safety net that keeps financial disasters from derailing your plans.

Here’s the trio you’ll want to prioritize:

- Life Insurance: If loved ones rely on your income, a term life policy is an affordable way to provide for them in case of the unexpected. Not married or no kids? Don’t write off life insurance yet. It can cover debts, like student loans, for your co-signer.

- Health Insurance: With advancing age comes a higher likelihood of healthcare costs. Ensure you’re enrolled in a comprehensive plan that balances premiums and out-of-pocket costs.

- Disability Insurance: This often-overlooked coverage provides income if you can’t work due to injury or illness. Think of it as a paycheck protector.

As your needs shift, it’s important to review policies annually or during major life transitions. You might find bundling auto, home, and liability insurance not only streamlines things but saves you money too.

This decade is all about setting priorities while staying flexible when life throws you curveballs (and it will!). With the right strategies, you can conquer your 30s feeling prepared, secure, and proud.

Thriving Beyond Your 30s

By the time you hit your 30s, it might feel like the financial puzzle pieces are falling into place, or maybe you’re just figuring out what the big picture even looks like.

Either way, moving past this decade is the perfect time to really thrive financially. This stage of life isn’t just about making ends meet; it’s about building, diversifying, and creating something meaningful for the future.

Here’s how you can take your financial strategy to the next level while protecting and growing your wealth.

Maximizing Retirement Contributions

Retirement might feel far away, but here’s the thing, time is your greatest ally. The earlier and more consistently you contribute, the more your money has the potential to grow.

It’s all thanks to compound interest, which essentially means your earnings generate more earnings over time, creating a snowball effect.

- Use Employer Matching: If your company offers a retirement plan with employer matching, make the most of it. It’s like leaving free money on the table if you don’t.

- Increase Contributions Gradually: Even a 1-2% increase annually can make a huge difference over time. Adjusting with salary increases can make it painless.

- Catch-Up Contributions: Once you hit 50, take advantage of additional contributions allowed by most retirement plans, like a 401(k) or IRA.

Imagine starting with a modest account and watching it grow exponentially over the years, it’s financial magic in action.

Want to see how compound interest changes the game? Check out this guide on compound interest and retirement savings.

Diversifying Investment Strategies

Relying on just one type of investment is like putting all your eggs in one basket. Don’t limit yourself. As you expand your financial portfolio, it’s time to learn about other investment options that offer stability, growth, or even passive income.

- Explore Real Estate: Consider purchasing a rental property, flipping homes, or even investing in REITs (Real Estate Investment Trusts) for more accessible options.

- Look at Mutual Funds or ETFs: These allow you to own a diversified mix of stocks or assets with less manual effort.

- Alternative Assets: From commodities like gold to cryptocurrency or even fine art, exploring alternative assets can provide unique opportunities if you’ve already covered the basics.

When properly diversified, your financial risk decreases because not everything in your portfolio is tied to the same outcome.

Creating a Legacy Plan

Building wealth is also about thinking generations ahead. Have you thought about what happens to your assets when you’re no longer here?

Estate planning ensures the legacy you’ve worked to build stays protected and benefits the people or causes you care about.

- Will & Trusts: A will specifies how your assets are distributed, but a trust can offer additional protection and flexibility, often avoiding probate.

- Consider Beneficiaries: Regularly review beneficiaries on accounts like life insurance, retirement funds, or savings accounts to ensure they’re up to date.

- Tax-Smart Strategies: Utilize tools like irrevocable trusts to reduce estate taxes and maximize the value passed down.

Setting up a plan might sound daunting, but think of it as protecting your life’s work. For ideas on where to begin, check out this estate planning guide.

By taking these steps, you’re setting yourself up for financial stability, true wealth-building and legacy creation. Your future self and perhaps even future generations will thank you.

Final Thoughts

Building a financial foundation is like planting seeds. The habits and choices you make today can flourish into security, freedom, and peace of mind tomorrow.

No matter your age or starting point, progress happens in small, consistent steps. Those efforts; creating a budget, saving for emergencies, or investing with confidence, pay off in a way that transforms more than just your wealth.

They uplift your entire sense of self and well-being, creating independence and options.

Are you ready for the next step of building your financial foundation? Start with tools and practices that feel approachable. You don’t have to overhaul everything overnight.

For more ideas on connecting financial wellness to emotional strength, check out how finances impact mental health. It’s all about taking the first step toward a fuller, more empowered life.

Your financial journey is not just about numbers, but about creating a life you love. So, why not start today and make this year one of lasting change.

Love what you see? Share the love with friends and pin it to your Pinterest. Every share and pin helps inspire more people to take control of their financial well-being.

Do subscribe and share so we can make positive changes together