Impulse spending used to control my wallet and my emotions. Those spur-of-the-moment buys felt great in the moment but left me with regret when bills came rolling in.

Sound familiar? It’s a tough cycle, but mindfulness changed everything for me.

Through embracing simple practices like breathing, pausing, and staying present, I learned to interrupt those automatic spending habits and make intentional choices.

The result? Thousands saved and a sense of calm I didn’t think was possible.

Small, intentional changes like engaging in mindful money habits, can make a big difference.

The Link Between Impulse Spending and Emotional Triggers

Impulse spending is rarely about the actual item you’re buying. It’s about feelings, habits, and sometimes, societal pressures.

Recognizing what’s driving those purchases is the first step in breaking the cycle.

When you understand why impulse buying happens and the emotions behind it, you arm yourself with the awareness needed to take back control of your finances.

Let’s unpack this together.

Why Impulse Buying Happens

Impulse spending often feels like a quick fix, but those spur-of-the-moment buys don’t come from nowhere. More often than not, it’s rooted in psychological factors, including the brain’s love of quick rewards.

Each swipe of a credit card can feel like a tiny celebration, thanks to the release of dopamine, a chemical in your brain that screams, “Yes, this feels amazing!”

But here’s the kicker: that feel-good rush is fleeting, while the regret (and the dent in your bank account) can linger for weeks.

Societal conditioning also plays a huge role. We’re constantly bombarded with messages like “treat yourself” or “you deserve it!” as if self-worth is tied to spending money.

It’s not. But marketing is designed to make you believe otherwise, creating a culture where spending becomes synonymous with self-care.

If you’d like help distinguishing genuine needs from fleeting wants, this beginner’s guide to mastering needs vs. wants is a great starting point.

Think of it this way: impulse buying is like a sugar rush. It temporarily satisfies, but without mindful consumption, it can wreak havoc on your long-term goals, whether they’re financial or emotional.

1. Identify Your Emotional Triggers

Before you can curb impulse spending, it’s essential to figure out what’s causing it. Chances are, there are specific feelings or situations that set you off and send you straight to the checkout button.

Here are some actionable steps to help you dig deeper:

- Start noticing patterns: Keep track of when you feel the strongest urge to spend. Are you stressed? Bored? Celebrating a win? Once you spot a pattern, you can start to understand the “why” behind the impulse.

- Pause before purchasing: It sounds simple, but stepping away can be a game-changer. Take a deep breath or count to 10 before completing any purchase. Often, the itch to buy fades just by giving yourself time to think.

- Ask yourself reflective questions: Does this align with my values? Do I really need this? Will this purchase bring lasting satisfaction or just momentary relief?

- Keep a journal: Write down what you were feeling before making any impulse purchase. Over time, you’ll start to see a clear picture of your spending triggers.

Recognizing emotional triggers is like finding the “why” in your spending habits puzzle.

While retail therapy can feel like a quick-win solution in the moment, addressing the underlying emotions is far more fulfilling in the long run.

Introducing Mindfulness: Your Secret Weapon to Financial Well-Being

Have you ever thought about how much of your spending is tied up in emotions? I used to blow through my budget because of mindless impulse purchases, only to regret it when reality hit.

That is until I discovered that mindfulness can be just as transformative for your bank account as it is for your mental health.

By pausing, breathing, and getting clear on what I truly value, I managed to save and finally feel in control of my finances. Let me show you how.

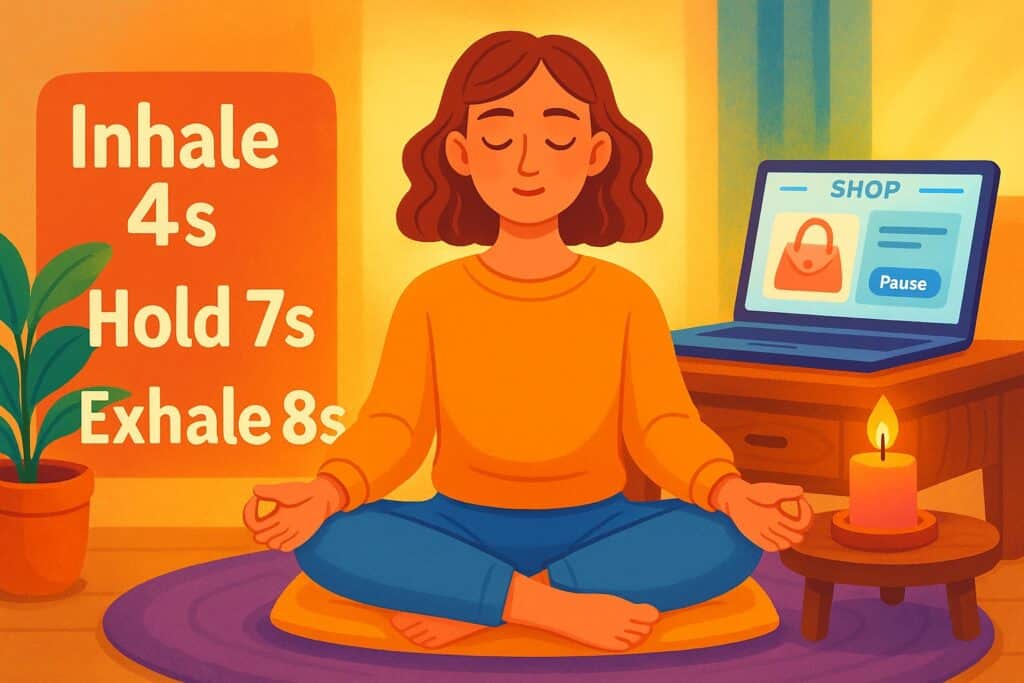

2. Breathing Techniques to Regain Focus

Picture this: You’ve had a stressful day, you’re scrolling through your favorite online store, and that “Add to Cart” button is calling your name.

Before you click, stop and try this simple breathing exercise:

- Sit comfortably and close your eyes.

- Inhale deeply through your nose for 4 seconds.

- Hold your breath for 7 seconds.

- Exhale slowly through your mouth for 8 seconds.

Repeat this cycle three times, focusing solely on the rhythm of your breath.

This simple technique helps ground you in the present, giving your brain a moment to reset before making a decision you’ll later regret.

Think of it as hitting the mental pause button when your impulse to buy wants to take over.

3. The Magic of Pausing Before Purchasing

There’s real power in pausing. Whenever I feel an urge to buy something unplanned, I’ve trained myself to stop and wait 24 hours.

Here’s why this works: it gives me space to clarify if the purchase aligns with my priorities or if it’s just a fleeting desire. Spoiler: Most of the time, it’s the latter.

Not convinced? Pausing can also help you identify whether a purchase fits into your long-term financial goals.

When I paired this pause practice with a solid budgeting approach, it was a total stress reliever.

For some handy tips on budgeting for your well-being, check out How Budgeting Can Reduce Stress. Your budget and your future self will thank you.

How Mindfulness Saves Real Money

Mindfulness is not just some “feel-good” concept. It’s a practical tool that leads to real savings.

Let me give you an example. Before embracing mindful money habits, I’d stop at coffee shops multiple times a week, often without thinking.

After practicing mindfulness, I started asking myself: “Why am I here? Is this latte going to improve my day, or can I enjoy the coffee I have at home instead?” The result? Hundreds of my money saved over the course of just a few months.

Here are a few other ways mindfulness has saved me money:

- Skipping unnecessary grocery items by sticking to a meal plan.

- Recognizing that retail therapy doesn’t actually address emotional needs.

- Saying no to subscription services I wasn’t fully utilizing.

For even more ideas on saving without sacrificing joy, take a peek at this article on Saving Smart Without Missing Out. Mindfulness is proof that less isn’t just more, it’s better.

If you’ve ever felt like your budget just isn’t working or your self-care routine needs a refresh, I’ve got something perfect for you. I created a fun quiz designed specifically to help you pinpoint your budgeting blind spots and uncover your unique self-care style.

Take the Money and Self-Care Quiz now, and you’ll get personalized tips that genuinely match your personality. No one-size-fits-all advice here!

My Personal Journey: How Mindfulness Saved Me Thousands

Mindfulness doesn’t just calm your mind, it reshapes how you handle your finances. For years, I was stuck in an endless cycle of impulse spending and regret.

Each time, I’d tell myself, “This is the last time I overspend.” But it wasn’t. That pattern kept me trapped in frustration until I stumbled upon mindfulness.

Some call it a mental trick, but honestly, it felt like opening a door I didn’t know existed. Let me share my story to show you how breathing, pausing, and awareness saved me thousands of money.

a-ha Moment: From Overspending to Freedom

We all have a moment in life where things just click, right? Mine started on a random Wednesday night. I was stressed and scrolling through my favorite online store, my cart already filled with things I didn’t need.

A pair of shoes, a new jacket, and yet another “must-have” kitchen gadget. Something felt different this time, though. It hit me: I wasn’t even sure why I was buying these things.

Instead of hitting the checkout button, I paused. That pause changed everything. I remembered reading about mindfulness techniques and decided to try one right there.

I focused on my breath, mentally stepped away from the cart, and asked myself why I was buying these items.

The answer? I was trying to soothe stress, but I knew it would only leave me feeling worse later.

I closed the tab, and for the first time in ages, it felt like I had taken control.

This realization sparked a transformation. I began pausing before every purchase, big or small. Slowly, I started to see the difference it made.

Not just in my bank account, but in my self-confidence.

4. Break the Cycle of Guilt and Overspending

If you’ve ever overspent and been consumed by guilt afterward, you know how heavy that feels. I was stuck in that guilt loop for years.

I’d spend impulsively, swear I’d do better next payday, and then repeat the process. What I didn’t realize at the time was that guilt was making things worse.

Instead of learning from my mistakes, I’d spend again just to escape the feeling. Even if for just a moment.

Here’s the truth: forgiveness matters. The moment I stopped beating myself up over past spending and gave myself grace, everything shifted.

I saw those mistakes not as failures, but as learning moments. Because of that mindset, I could finally focus on creating healthier habits instead of staying stuck in the shame spiral.

Forgiving yourself is not just about emotional balance, it’s also a key to making real progress.

If you’re battling financial stress and wondering how to start fresh, you’ll appreciate this breakdown of How Financial Stress Affects You and 13 Ways to Feel Better.

The small steps listed there really helped me get unstuck when I needed it most.

Changing my perspective wasn’t easy, but it was worth it. When I shifted from guilt-driven decisions to intentional ones, I began living with more freedom, and less clutter, both financially and emotionally.

Every action I take now feels purposeful. Whether it’s saying “no” to a purchase or celebrating financial wins, mindfulness has saved me money and given me the peace I didn’t expect to find.

5. Set Intentions Before Every Purchase

Every dollar you spend is a statement about what you value. So before you pull out your card, ask yourself: Does this line up with what matters most to me?

For example, if one of your goals is to travel more, purchases like eating out every day might feel less important when they’re seen as taking away from saving for that dream trip.

Try adding a short daily affirmation to your routine, like, “I spend money intentionally and in alignment with my goals.” This small habit can do wonders for helping you reset your mindset.

Journaling can also be a great practice. Start by outlining your personal values and financial goals at the beginning of each month.

Writing down your intentions helps solidify them, making it easier to stay on track when impulse spending strikes.

To dive deeper into intentional financial management and self-care, this article about 15 Financial Self-Care Tips offers practical ideas to align your money choices with your well-being.

6. Track Wins, Not Just Expenses

Most budget advice focuses on tracking what you spend, but I like to take it a step further by celebrating mindful wins.

Did you swap a fancy latte for home-brewed coffee this week? Or pause before buying that extra pair of shoes you didn’t really need?

Celebrate those! Each small win adds up to major progress over time.

Here’s what I do: keep a specific section in your notebook or budgeting app to jot down every positive, mindful choice. Treat this like a gratitude journal but for money!

Doing this gives you a record of how amazing you’re doing . Which is super motivating on days when mindful spending feels like a challenge.

Remember, it’s not just about what you don’t spend; it’s about the peace you gain from staying true to your values.

If staying mindful with your money also means finding self-care on a budget, this post about prioritizing self-care while saving has some great tips. Mindful choices touch both your heart and your wallet.

7. Create a Mindful Spending Wishlist

Ever had that experience where you just had to have something, but a week later, it’s collecting dust? I’ve been there more times than I care to admit. Here’s what finally worked for me: creating a wish list.

Instead of clicking “buy” immediately, I jot down the item I want along with the date. Then I wait a full week before revisiting it. Surprisingly, most times, after seven days, I realize I don’t actually want or need the item anymore.

This simple trick can save you money each month. Plus, when you do eventually buy something from your list, it feels like a thoughtful reward rather than a mindless purchase.

8. Try a Social Media Spending Detox

Social media is sneaky when it comes to impulse buys. One minute you’re casually scrolling; the next thing you know, you’ve ordered three things you never planned on buying.

Here’s my solution: Take short social media detox breaks, especially when you’re stressed or tired (prime impulse spending territory). Step away from Instagram, Pinterest, or TikTok for a few hours or even a day, and notice how your urge to spend fades.

Trust me, your wallet (and your mind) will thank you.

9. Take a Gratitude Spending Challenge

One of my favorite mindfulness tools is gratitude. Turns out, gratitude also helped curb my spending. Here’s how the Gratitude Spending Challenge works:

Each time you’re tempted by an impulse buy, pause and quickly write down three things you already own that you’re grateful for.

Before buying new clothes, I remember the outfits I already have and love. Before grabbing another gadget, I remind myself of the tech that’s already serving me perfectly.

It’s amazing how often gratitude completely shifts your desire to spend impulsively. When you appreciate what you already have, you naturally spend less.

10. Take the Money and Self-Care Quiz

This is one of my favorite ways to stay motivated on your mindful money journey!

If you’ve ever wondered how your money habits link to self-care (or where those tricky blind spots in your budget might be hiding), you’ll love this fun resource I created just for you.

Take the Money and Self-Care Quiz, and you’ll get personalized tips that resonate with your goals and personality.

It’s a quick and enjoyable check-in to uncover insights about your spending while discovering budgeting techniques that prioritize both your finances and well-being.

These tips are not about depriving yourself; they’re about finding deeper meaning in every money you spend.

Mindful money habits let you blend financial clarity with emotional peace, creating a life that feels fulfilling instead of stressful.

Final Thoughts – Mindful Money Habits to Stop Impulse Spending and Save Thousands

Breathing, pausing, and mindfulness turned out to be the ultimate tools for me to take control of my spending and, honestly, my peace of mind.

It’s about saving money, creating space to feel intentional, calm, and confident in every choice. With each pause before a purchase, I moved one step closer to aligning my spending with the life I actually want to live.

If you are ready to discover mindfulness in more areas of your life, check out 7 Powerful Ways Financial Wellness and Mental Health Connect to see how emotional and financial well-being go hand in hand.

And if you’re curious about mindfulness practices beyond finances, this piece on how to deal with uncertainty offers more ideas to cultivate focus and self-awareness.

For more on the psychology behind emotional purchases and how to manage them effectively, this guide on emotional spending offers some great insights.

Let’s make mindful money habits a movement, starting with you! If this post resonated, pass it on. Someone else might need these simple reminders to breathe, pause, and spend with purpose.

Share it, subscribe, and let’s pave the way to financial freedom and inner calm—together.